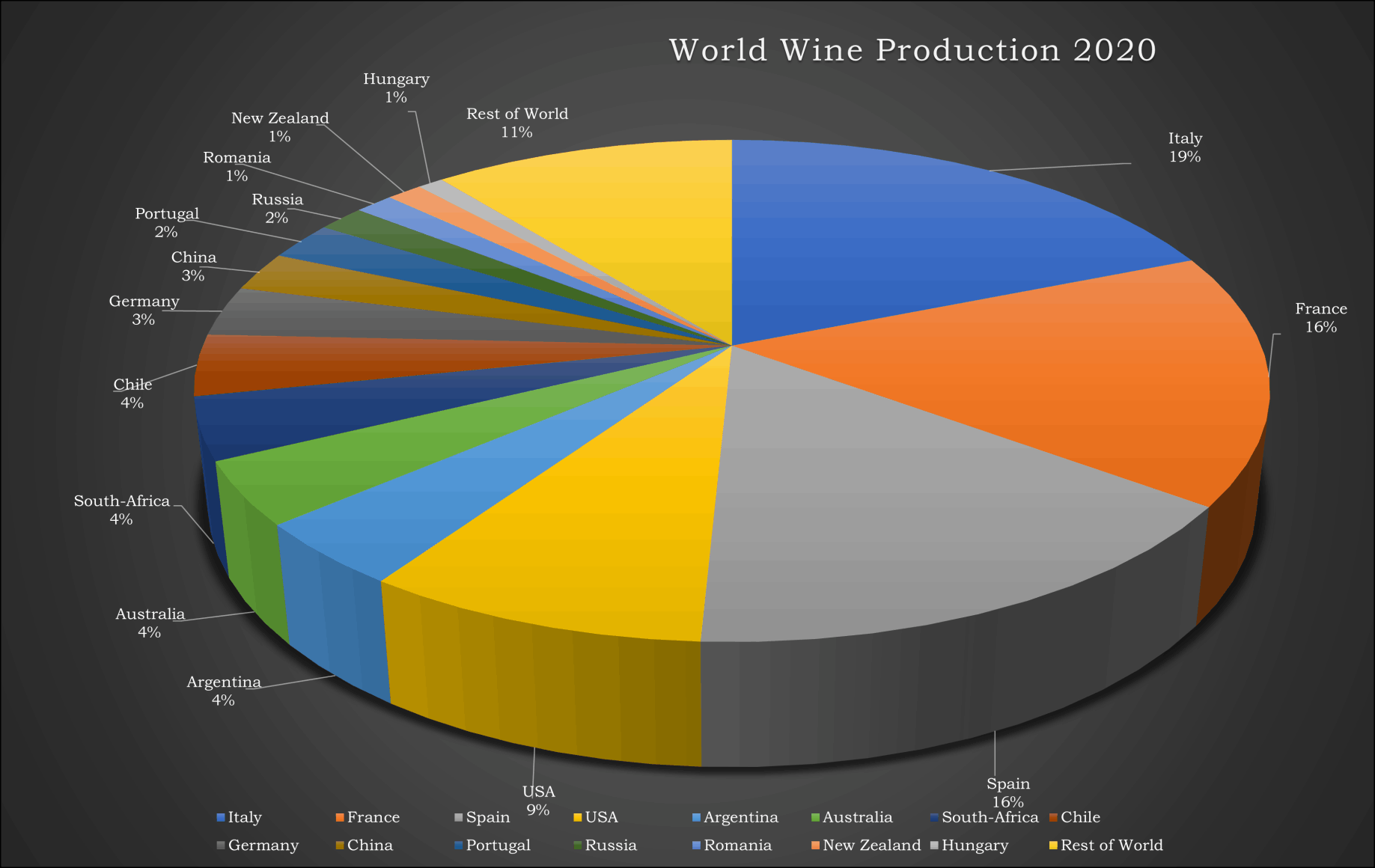

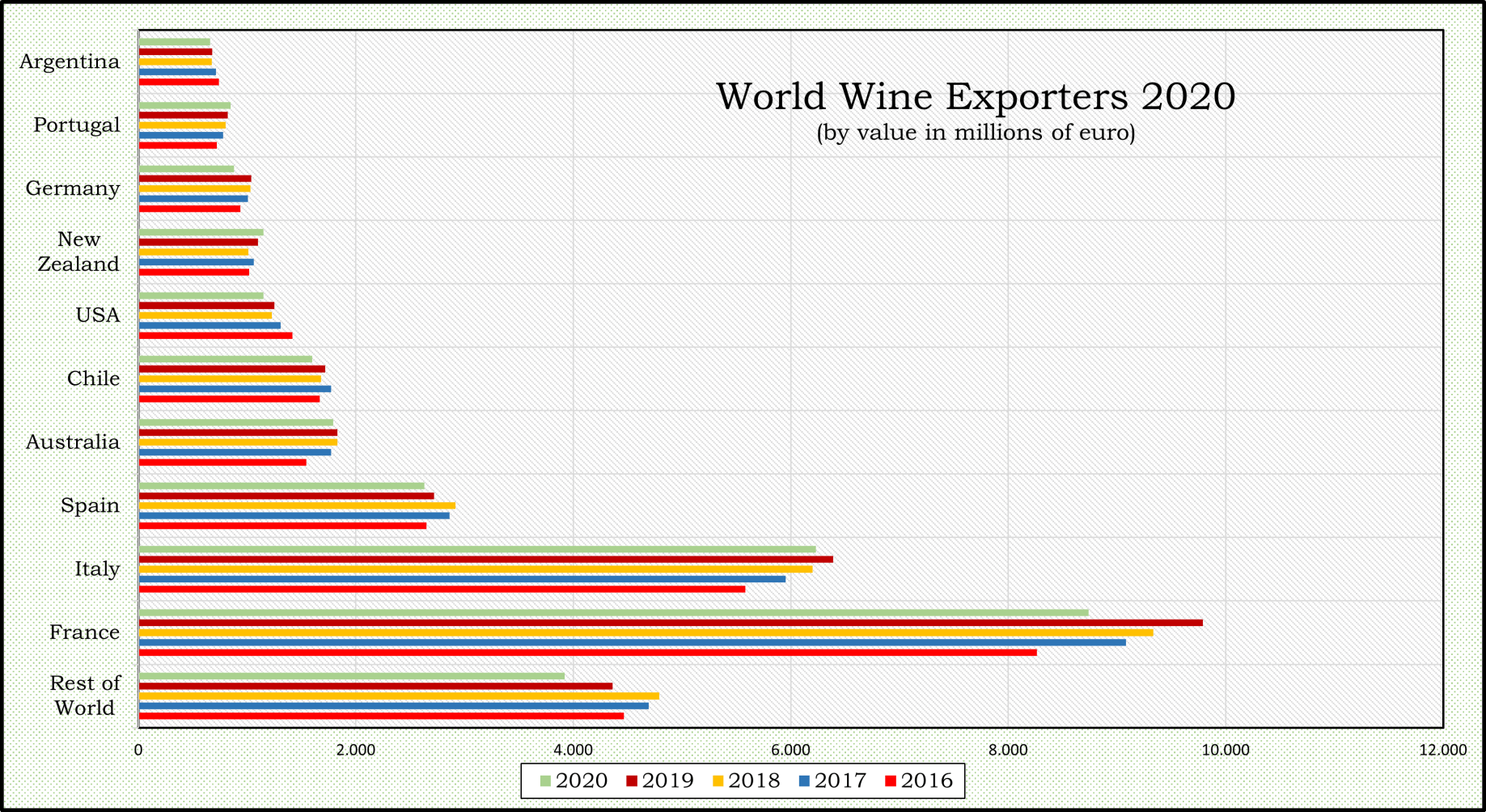

In the last decade, the wine market has evolved enormously both in terms of production and distribution. Within the Old World, a quality-driven and native Italy rivals more than ever with the historically dominant France. Spain, Portugal and Austria are also constantly showing their vast potential. These countries are increasingly focusing on their native grape varieties. In fact, these grape varieties are now also being planted more and more widely in the New World wine countries. Climate change also plays a huge role in all this. Native grape varieties are often more resistant to the local climatology. They have a better natural resistance to climate variations, produce more acidity in the region where they are historically anchored and ultimately deliver more elegant and balanced wines.

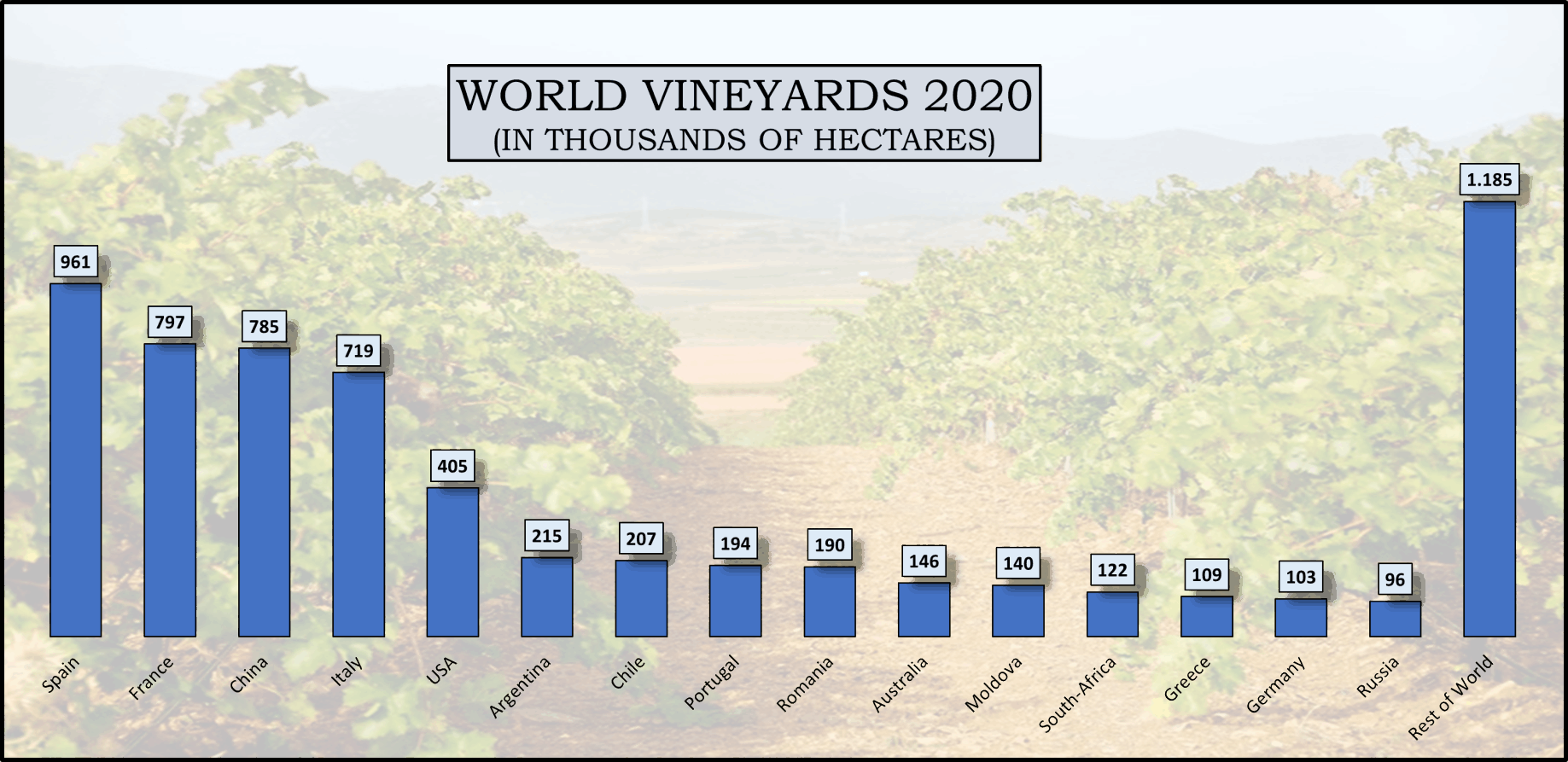

Climate change and the reduction of CO2 emissions are a major challenge for the wine world, perhaps even bigger than the once disastrous phylloxera plague in the late 19th century. In wine-producing countries, vineyards cover on average less than 10% of the agricultural area, but in some cases represent 25% of pesticide use. The viticulture of the future is one with a vision in which organic farming would only be too simple a summary of the problem. It also makes little sense to measure yourself a clear conscious by planting a hectare of forest for every new hectare of vineyard you create. This is often just window dressing, and most of the time only a plaster for a wooden leg, so to speak. Like we can imitate sugar for our own body and metabolism, we can also give signals to the land and nature so that it responds positively to our presence and the crops we plant.

Respecting the land through, among other things, regenerative and diversifying plantations helps our CO2 footprint further and faster than afforestation compensation or the sometimes-insufficient rules and commercial compromises of the organic standards.

We at European Vineyards Fund do not only focus on the indigenous grape varieties and their natural environment, but we are also socially committed to get the local population fully involved in the regeneration of their land, in regaining their self-esteem and to help them believe in their own natural potential. The reason we initially selected the Iberian Peninsula to start with is no surprise at all. Despite the climate change, Spain and Portugal offer unprecedented opportunities. The fact that large parts of ideal situated land still can be cultivated and sometimes even have to be discovered, means that entering the market and making the necessary investments can still be done at very favourable prices.

It´s not just the wine production which is undergoing an enormous transformation, the historical distribution channels are also being put under pressure and are being forced to reinvent themselves continuously or disappear. The disruption of the traditional wine trade is even worse than 30-40 years ago when supermarket chains started offering wine to their clients. Initially the reactions of the specialist wine trading companies were pitying. However, some of the most established values from father to son ran into problems because of habituation, lack of dynamism and not growing with the changing market standards of customer service. Claiming exclusivities both in terms of product and distribution regions made their world smaller and smaller, up to the point where large-scale distribution has now taken over up to

85% of trade in many countries.

And history repeats itself.

The digital network and the online business would only play an informative role for the wine world. The customer would surely always want to taste. True for a part of the online sales but the major part is sold in three clicks because of the offer being presented super attractive and claims to be a bargain.

Even before covid and the hectic 2020-21 period of lockdowns, it was already clear that wine online would not be a business in the periphery. It’s here to stay and we ain’t seen nothing yet!

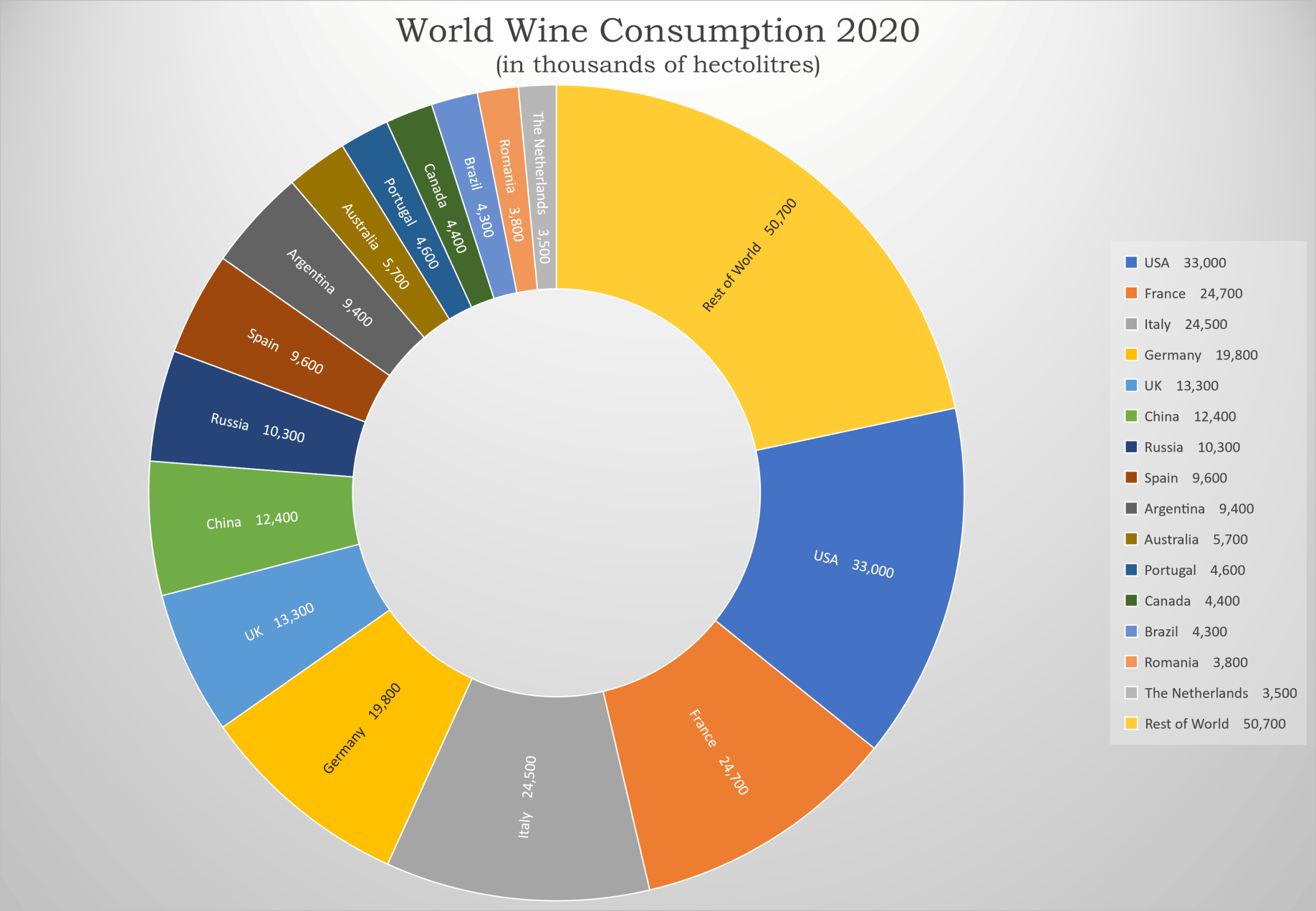

Through the various underlying structures of the fund, we have a solid relationship and connection with all distribution channels worldwide and we are on board with retail, discount, specialist retailers and the larger online players. Along with the shifting of wealth, the consumption of wine will also shift. Most markets in the world are already used to the consumption of beer and alcohol. Within alcohol consuming markets appreciating fine wine is a process that often coincides with softening the culture in its prosperity. A few of the largest countries in the world are at that tipping point and, in addition to the already existing Western wine market, will soon become top customers for premium wines.

European Vineyards Fund is very well positioned to take full advantage of this rapidly changing wine culture and to become a key player in this ever-growing market.